Learning Money Management That Actually Sticks

We don't lecture at you from a whiteboard. Our approach mixes real scenarios with hands-on practice—because reading about budgets is one thing, but building one yourself changes everything. You'll work through situations people actually face, not textbook problems that feel detached from reality.

Start Your JourneyYour Path From Basics to Confidence

We've structured our programs around how people actually learn financial skills—starting with fundamentals and building toward sophisticated strategies you can apply immediately.

Foundation Building

Weeks 1-4Most people skip this part and wonder why nothing clicks later. We start with the mental frameworks that make financial decisions easier—understanding your relationship with money before diving into spreadsheets.

- Map your current financial reality without judgment

- Identify spending patterns you didn't know existed

- Build a tracking system that works for your lifestyle

- Learn why most budgets fail (and how to avoid that)

Practical Systems Development

Weeks 5-10This is where theory meets your actual bank account. You'll design systems for managing day-to-day finances, handling irregular expenses, and making progress on goals without feeling restricted.

- Create automation that reduces decision fatigue

- Balance competing priorities with limited resources

- Handle unexpected expenses without derailing everything

- Adjust your approach as circumstances change

Strategic Planning

Weeks 11-16Once you've got solid daily habits, we look further ahead. Building wealth isn't about one big move—it's about consistent small decisions that compound over time.

- Evaluate investment options based on your situation

- Understand risk in practical, not theoretical, terms

- Plan for major life transitions financially

- Develop strategies that adapt as you grow

Advanced Application

Weeks 17-24By this point, you're not following templates anymore. You're making informed decisions based on your values and goals, adjusting strategies when needed, and thinking several moves ahead.

- Optimize tax efficiency within Australian regulations

- Coordinate multiple financial goals simultaneously

- Recognize when to seek specialized advice

- Teach others what you've learned (solidifies your knowledge)

How We Actually Teach This Stuff

Context Before Concepts

We explain why something matters before teaching you how to do it. When you understand the reasoning, techniques make sense instead of feeling like arbitrary rules to memorize.

Practice With Real Numbers

You'll work with realistic scenarios based on actual Australian salaries, expenses, and financial situations. No hypothetical perfection—just messy reality that resembles what you're dealing with.

Mistakes Are Part of Learning

Our exercises let you test strategies in a safe environment where getting it wrong teaches you more than getting it right. You'll figure out what doesn't work for you before it costs you anything.

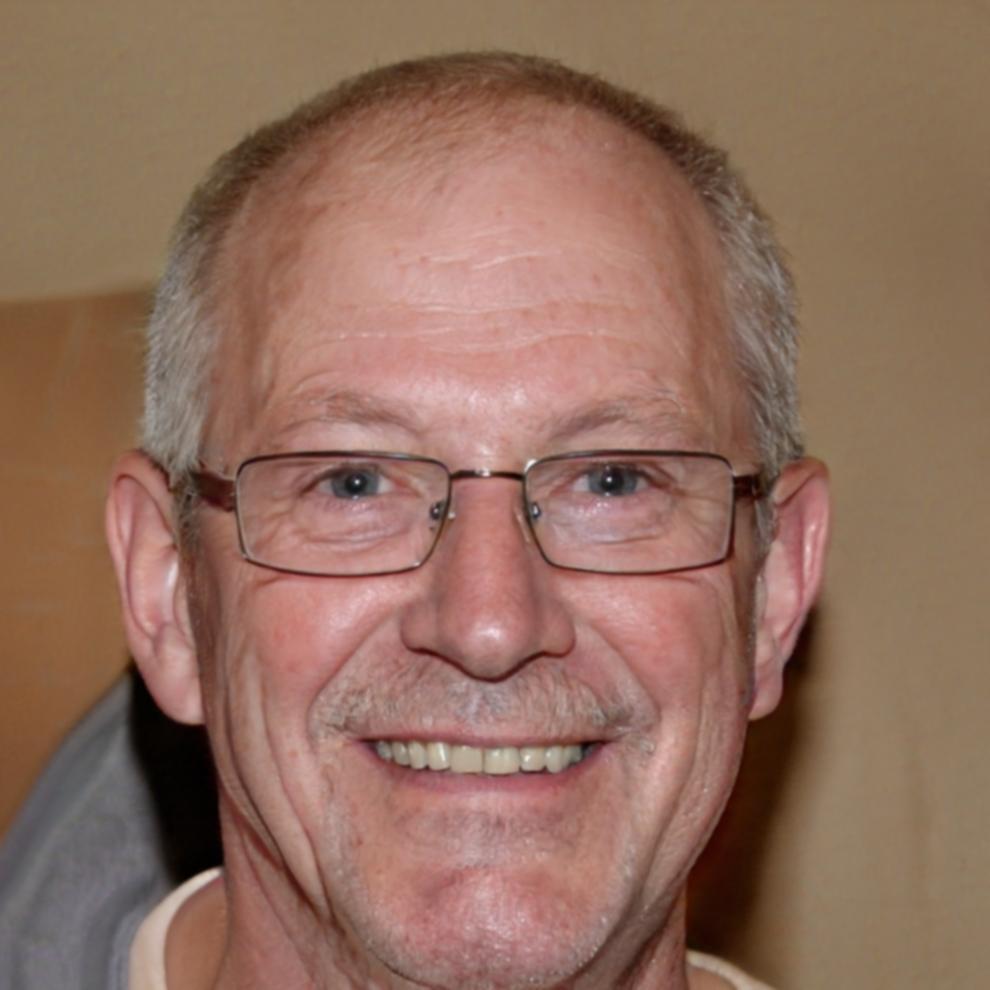

Callum Braeburn

Lead Instructor & Program Developer

I spent fifteen years as a financial advisor before realizing most people don't need complex strategies—they need clarity on basics that somehow never got explained properly. After watching too many clients struggle with concepts that should've been straightforward, I started designing education that actually fills those gaps. Now I work with people who are tired of feeling confused about money and want practical knowledge without the industry jargon.

Teaching Philosophy

"Financial literacy isn't about memorizing formulas—it's about developing judgment. I focus on helping people understand the trade-offs in every decision so they can figure out what works for their specific situation, not just follow someone else's template."